Guests to the USA can and can purchase journey medical insurance coverage.

U.S. well being care prices are the best on the earth, due to this fact it’s crucial you put money into a journey medical insurance coverage coverage to guard you from monetary smash ought to a medical emergency happen whereas your dad and mom are touring to the USA.

Greatest customer insurance coverage for fogeys visiting USA

In case your dad and mom are visiting you in the USA, we advocate you get customer insurance coverage for fogeys.

You by no means know if you may want it. A mum or dad may fall and break her hand or perhaps expertise an acute onset of a pre-existing situation. In that case, you’ll need to be ready.

Think about the next suppliers for the perfect journey insurance coverage for fogeys visiting the USA.

Atlas America

Atlas America gives complete insurance coverage for non-U.S. residents touring outdoors their nation, and it’s a great choice to think about when trying to find customer insurance coverage for fogeys visiting the USA. Journeys between 5 and 364 days lengthy are coated.

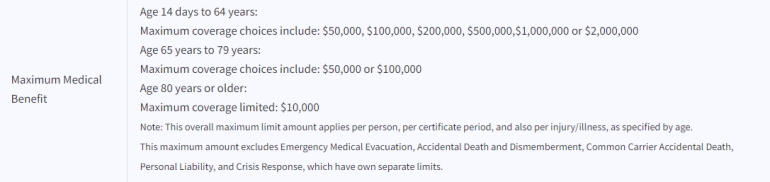

When purchasing for protection, you should choose a coverage most (the amount of cash an insurance coverage supplier pays for coated medical bills) starting from $50,000 to $2 million.

Relying on the age of your dad and mom, the utmost will get capped. For instance, in case your dad and mom are of their 70s, the utmost quantity out there for coverage most is $100,000. For folks older than 80, it’s decreased to $10,000.

You even have to decide on a deductible, which ranges from $zero to $5,000 and impacts the overall value of a coverage. After you deplete your deductible, the plan covers 100% of the invoice as much as the coverage most (so long as you go to in-network suppliers).

An Atlas America coverage contains the next medical bills:

Atlas America medical protection

-

Doctor visits.

-

Digital go to/telemedicine.

-

Diagnostic X-rays and lab companies.

-

Outpatient and inpatient surgical procedure.

-

Anesthesia.

-

Hospital room and board.

-

Intensive care unit.

-

Acute onset for pre-existing circumstances (for guests youthful than 80 years outdated).

-

Prescribed drugs.

-

Emergency dental remedy.

-

Pressing care or walk-in clinics incur a $15 copay (not topic to deductible, until you choose $zero deductible).

-

Emergency room visits that don’t end in hospitalization are topic to a $200 penalty.

Non-obligatory coverages embody (for an upcharge):

-

Unintentional loss of life and dismemberment.

-

Disaster response with pure catastrophe evacuation.

-

Private legal responsibility.

So, let’s take into account a pattern 30-day journey for a 60-year-old mum or dad visiting you in the USA. The plan features a $100,000 lifetime most and a $500 deductible.

This Atlas America plan costs out at $195.30. The quote doesn’t embody any elective coverages.

Atlas America participates within the UnitedHealthcare PPO community, that means you may be coated in the event you discover a well being supplier on the UnitedHealthcare community search.

In the event you seek for protection by means of WorldTrips, you’ll discover the identical Atlas journey medical insurance coverage plan.

Beacon America

Beacon America gives an alternative choice for journey insurance coverage for fogeys visiting the USA. It covers journeys between 5 and 364 days in size.

Much like the Atlas America plan, you should choose a coverage most when purchasing for protection, however the vary is decrease — from $25,000 to $1,100,000. The utmost coverage quantity is capped at $50,000 for these older than 70 and at $12,000 for many who are older than 80.

Beacon America deductibles vary from $zero to $2,500. The plan covers 100% as much as the coverage most after you employ up the deductible (for in-network suppliers). Beacon America additionally participates within the UnitedHealthcare PPO community.

A Beacon America coverage contains the next medical bills:

Beacon America medical protection

-

Doctor visits.

-

Diagnostic X-rays and lab companies.

-

Outpatient and inpatient surgical procedure.

-

Anesthesia.

-

Hospital room and board.

-

Intensive care unit.

-

Acute onset for pre-existing circumstances (for guests youthful than 70 years outdated).

-

Prescribed drugs.

-

Pressing care or walk-in clinics incur a $35 copay (not topic to deductible).

-

Emergency room visits that don’t end in hospitalization are topic to a $350 penalty.

You’ll be able to add an elective sports activities rider that can present as much as $50,000 most protection for excessive sports activities, equivalent to mountain biking, horseback using, white water rafting, snowmobiling or zip-lining.

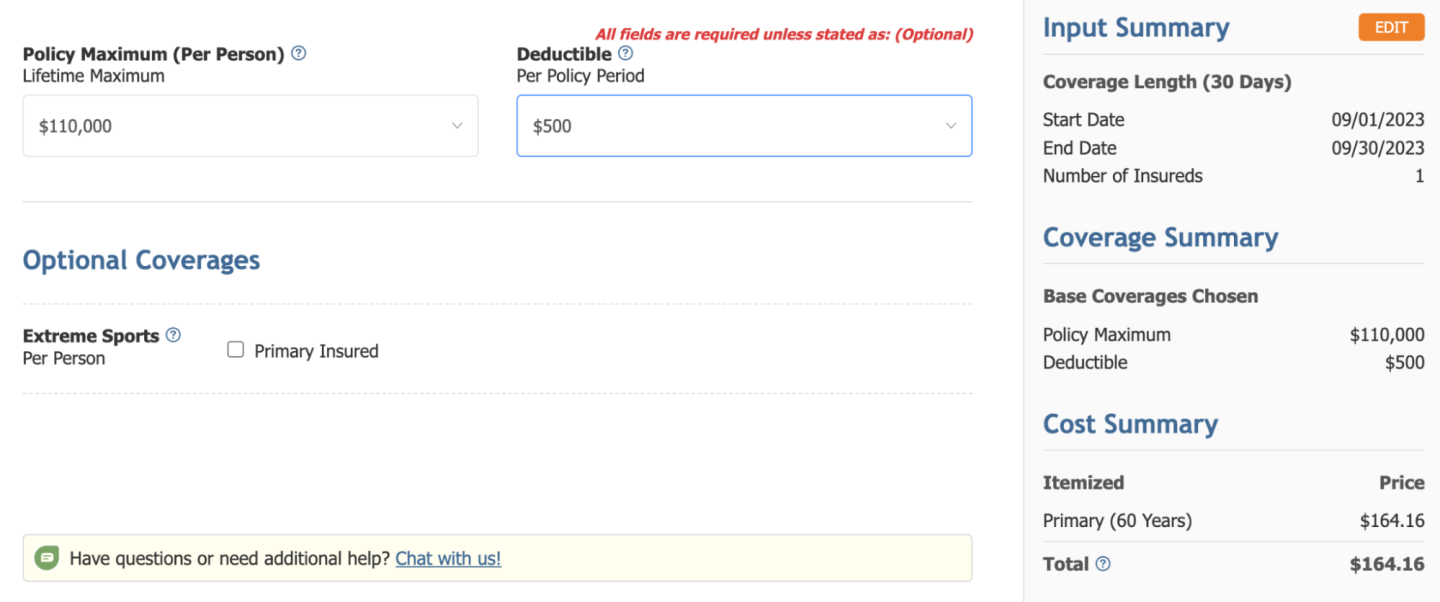

So, let’s seek for a plan with the identical parameters for guests insurance coverage for fogeys as earlier than: a 30-day journey for a 60-year-old mum or dad touring to the USA. The plan features a $110,000 lifetime most and a $500 deductible.

This Beacon America plan comes out to $164.16, $31 cheaper than the plan supplied by Atlas America.

Patriot America Plus

Patriot America Plus from IMG is an alternative choice for medical insurance for fogeys visiting the USA. It’s out there for journeys as much as 12 months in size (with an choice to increase to 36 months, relying on the plan). Three plans can be found below the Patriot America Journey Collection: Patriot Lite, Patriot Plus and Patriot Platinum.

You’ll be able to count on the next protection with every plan sort.

|

Patriot Lite |

Patriot Plus |

Patriot Platinum |

|

|---|---|---|---|

|

Coverage most |

As much as $1 million. |

As much as $1 million. |

As much as $eight million. |

|

Deductible |

$zero to $2,500. |

$zero to $2,500. |

$zero to $25,000. |

|

Emergency medical evacuation |

$1 million. |

$1 million. |

As much as coverage most restrict. |

|

In-network protection |

|||

|

Out-of-network protection |

80% as much as $5,000, then 100%. |

80% as much as $5,000, then 100%. |

90% as much as $5,000, then 100%. |

|

COVID-19 protection |

|||

|

Acute onset of pre-existing circumstances (for vacationers below the age of 70) |

|||

|

Telehealth |

|||

|

Evacuation Plus |

The Patriot plans embody the next:

Patriot plan medical protection

-

Doctor visits.

-

Diagnostic X-rays and lab companies.

-

Outpatient and inpatient surgical procedure.

-

Anesthesia.

-

Hospital room and board.

-

Intensive care unit.

-

Chemotherapy or radiation remedy.

-

Chiropractic care.

-

Bodily remedy.

-

Prescribed drugs.

-

Pressing care clinics incur a $25 copay (not topic to deductible, until you choose $zero deductible).

-

Stroll-in clinics incur a $15 copay (not topic to deductible, until you choose $zero deductible).

-

Emergency room visits that don’t end in hospitalization are topic to a $250 penalty.

As soon as once more, Patriot plans from IMG present U.S. vacationers with entry to the UnitedHealthcare community.

Patriot plans present some journey protections, equivalent to misplaced baggage and terrorism, as properly. With a Patriot America Plus plan, it’s also possible to add an elective system safety rider to cowl your cellular phone and a supplemental journey sports activities rider.

A 30-day Patriot Plus plan with a $100,000 coverage most and a $500 deductible comes out to $165.78 for a 60-year-old feminine resident of Mexico touring to the USA.

Secure Travels USA

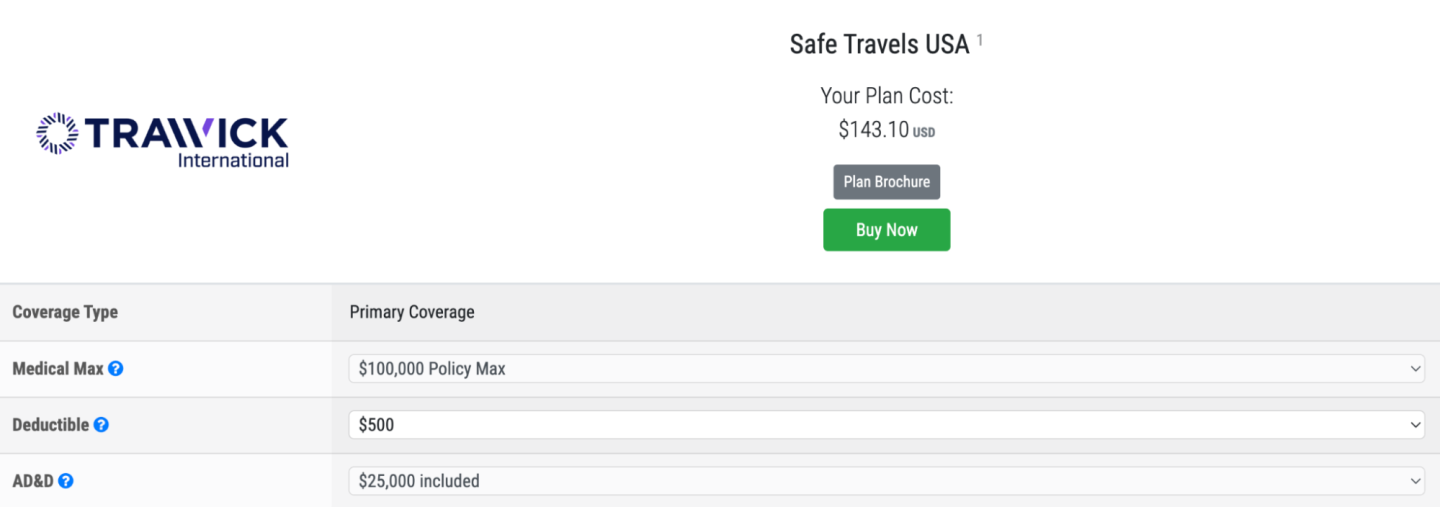

Secure Travels USA from Trawick Worldwide covers non-U.S. residents touring to different nations, together with the USA. Actually, this plan isn’t out there to U.S. residents and Inexperienced Card holders. The protection period is between 5 days and 364 days.

Coverage most quantities vary from $50,000 to $1 million, and deductibles range between $zero and $5,000. Secure Travels USA plans are within the First Well being community.

A Secure Travels USA plan contains the next medical bills:

Secure Travels USA medical protection

-

Doctor visits.

-

COVID-19 bills.

-

Diagnostic X-rays.

-

Outpatient medical and ambulance.

-

Hospital room and board.

-

Chiropractic care, bodily drugs and bodily remedy ($50 per go to per day).

-

Acute onset for pre-existing circumstances (as much as $1,000).

-

Dental remedy (as much as $250 for harm or ache).

-

Pressing care clinics incur a $30 copay (not topic to deductible, until you choose $zero deductible).

Secure Travels USA considers COVID-19 to be some other sickness, that means the medical protection contains sicknesses associated to the virus. Additionally, journey safety advantages, equivalent to journey interruption, misplaced baggage, and unintended loss of life and dismemberment, are included.

You’ll be able to add a supplementary sports activities exercise protection for accidents sustained throughout archery, tennis, swimming, golf, basketball and different sports activities listed within the coverage. Return to house nation protection can also be elective (in case your journey is longer than 30 days).

The Secure Travels USA plan with a most restrict of $100,000 and a $500 deductible will value $143.10 for a 60-year-old mum or dad from Mexico.

CoverAmerica-Gold

CoverAmerica-Gold is a complete journey medical insurance coverage plan from Sirius Specialty Insurance coverage Company for non-U.S. residents visiting the USA. Like different insurance coverage suppliers, you should buy protection for no less than 5 days and, at most, 365 days (with an choice to increase by one other 365 days). The CoverAmerica-Gold plan is accessible to oldsters as much as 79 years outdated.

Most coverage protection ranges from $50,000 to $250,000, and the deductible ranges from $100 to $5,000, so there’s no choice to select a $zero deductible like with different plans talked about above. CoverAmerica-Gold participates within the UnitedHealthcare PPO community.

A CoverAmerica-Gold coverage contains the next medical bills:

-

Doctor visits.

-

COVID-19 bills.

-

Diagnostic X-rays and lab companies.

-

Inpatient surgical remedy.

-

Hospital room and board.

-

Acute onset for pre-existing circumstances (for guests youthful than 70 years outdated, protection as much as $3,000 for ages 70 to 79).

-

Emergency dental remedy (as much as $250).

-

Pressing care consultations incur a $15 copay.

The CoverAmerica-Gold insurance coverage plan additionally affords journey advantages, equivalent to journey interruption, emergency medical evacuation and return of mortal stays. An journey sports activities rider can also be out there as an elective add-on.

The CoverAmerica-Gold coverage with the identical most restrict of $100,000 and a $500 deductible will set a 60-year-old customer from Mexico again $191.10.

Guests insurance coverage for fogeys recapped

Getting reunited with household is a good feeling, particularly if you stay far-off and the visits are uncommon. Nevertheless, you don’t need your dad and mom’ keep in the USA to be overshadowed by enormous medical payments ought to an accident or a medical emergency happen.

If you’d like COVID-19 protection to be included, go together with Patriot America’s Plus and Platinum plans. Secure Travels USA and CoverAmerica-Gold additionally present COVID-19 medical protection.

In the event you’re acquainted with the UnitedHealthcare PPO community, Atlas America, Beacon America, CoverAmerica-Gold and Patriot America Plus are all on that community.

For these searching for additional journey protections, Patriot America Plus, Secure Travels USA and CoverAmerica-Gold are secure selections for fogeys’ insurance coverage visiting the USA.

And keep in mind to buy round and examine choices because the size of the go to, coverage maximums and deductibles will decide the ultimate plan value.

How one can maximize your rewards

You need a journey bank card that prioritizes what’s necessary to you. Listed below are our picks for the greatest journey bank cards of 2023, together with these greatest for: