Since well being care might be costly within the U.S., it’s necessary that guests have insurance coverage protection, aka guests insurance coverage or journey medical insurance coverage, in case one thing occurs that requires medical consideration mid-trip.

Whether or not you have got protection for journey within the U.S. is determined by your well being care plan in your house nation. However should you do not, you will want to purchase a coverage from a third-party insurance coverage supplier. A number of firms promote this sort of customer insurance coverage, and every firm and coverage is a bit completely different. Let’s take a look at which is finest for you.

Journey insurance coverage fundamentals

First, just a few fundamentals about customer insurance coverage. Two sorts can be found: journey medical insurance coverage and journey insurance coverage.

-

Journey medical insurance coverage covers medical bills that you could be incur whereas touring internationally, like a go to to the physician, a visit to the hospital and medical evacuation and repatriation.

-

Journey insurance coverage often covers restricted medical bills like emergency care and might compensate you in case your journey is delayed, it’s essential to depart the journey early or you need to cancel the journey. It’s designed that can assist you defend the funding you’re making as you put together to journey.

Commonplace journey insurance coverage won’t cowl a go to to the physician except it’s an emergency.

🤓Nerdy Tip

It’s necessary to verify any pre-existing situations are coated if the customer has any. Some insurance policies exclude them.

Greatest guests insurance coverage insurance policies

With so many sorts of holiday makers insurance coverage insurance policies, which is the very best?

To make comparisons, we acquired quotes from a number of firms utilizing Squaremouth, a web site to seek for various kinds of journey insurance coverage in a single place.

The parameters we set are for a 49-year-old citizen and resident of Spain touring to the U.S. on Could 1-31, 2024.

The quotes do not embrace cancellation protection; these examples are for medical protection solely. To get a quote, the hypothetical deposit for the journey was paid on Feb. 15.

Since we’re searching for a coverage that can cowl medical look after guests, there are a number of medical filters to pick out: emergency medical ($100,000 or extra), medical evacuation ($100,000 or extra) and protection for pre-existing medical situations.

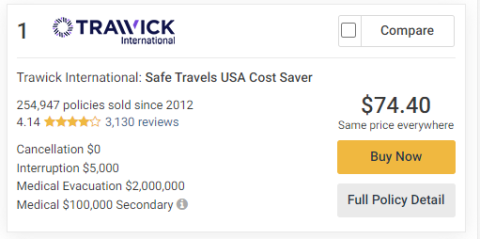

The search got here up with 9 outcomes ranging in worth from $74.40 to $179.18.

For the bottom worth: Trawick Worldwide

Trawick insurance policies use the FirstHealth PPO community.

The coverage as quoted has a $250 deductible and consists of $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption protection. It has restricted protection for pre-existing situations.

It’s potential to vary the deductible to as little as $zero or elevate it to $5,000.

The identical firm has one other coverage, the Trawick Worldwide Protected Travels USA Complete coverage, that’s higher at protecting pre-existing situations and prices a little bit extra — $89.59.

The overall protection is similar because the inexpensive coverage, and the Protected Travels USA Complete possibility provides protection for acute onset of a pre-existing situation. it’s potential to vary the deductible quantity to $zero or go as much as $5,000.

For customizing choices: WorldTrips

Some insurance policies are offered as is, whereas others permit some flexibility relying on what’s necessary to you.

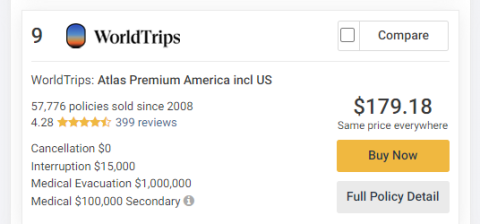

The WorldTrips Atlas Premium America coverage for $179.18 permits lots of customization.

It was additionally the most costly of the 9 insurance policies Squaremouth instructed.

It’s potential to customise the emergency medical protection and pre-existing situation protection and medical deductible. The coverage additionally consists of $15,000 in journey interruption protection, the very best of any of the 9 insurance policies accessible.

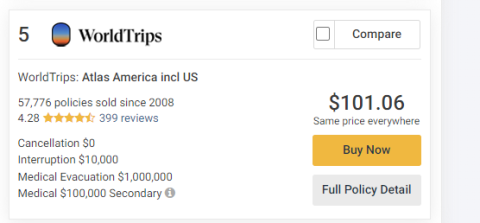

For pre-existing situations: WorldTrips

If the traveler has a pre-existing situation, insurance policies from WorldTrips Atlas America are your finest guess. The WorldTrips Atlas America coverage in our comparability prices $101.06.

The coverage as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an sudden recurrence of a pre-existing situation.

The deductible can also be accessible for personalisation from $zero to $5,000.

The PPO community for Atlas America Insurance coverage is United Healthcare.

The WorldTrips Atlas Premium America coverage talked about above can also be good for pre-existing situation protection.

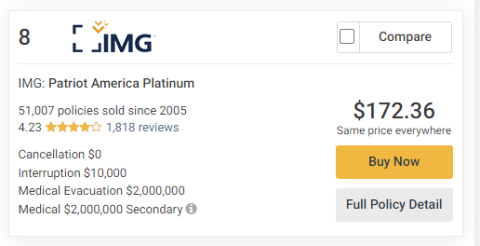

For highest medical protection restrict: IMG

Whereas eight of the 9 insurance policies had $100,000 in secondary medical protection, one had a restrict of $2 million.

The IMG Patriot America Platinum coverage has a premium of $172.36 together with a excessive medical evacuation restrict of $2 million and interruption protection of $10,000.

If $2 million in medical protection shouldn’t be sufficient, it’s potential to extend that quantity to an $eight million coverage restrict.

It’s not potential to vary the extent of protection for preexisting situations from the excessive $1 million restrict in emergency medical care and $25,000 in medical evacuation for an sudden recurrence.

It’s potential to vary the deductible from $zero all the way in which as much as $25,000.

Different choices to think about

Seven Corners had two insurance policies come up within the outcomes, the Seven Corners Journey Medical Fundamental for $98.27 and the Seven Corners Journey Medical Selection coverage for $136.71. Each of the Seven Corners insurance policies embrace protection for hurricane and climate, and the inexpensive coverage covers acts of terrorism.

The underside line

Having insurance coverage to cowl sudden medical bills for anybody visiting the U.S. could be a sensible cash transfer.

An sickness or accident may trigger monetary issues for guests due to doubtlessly having to pay for full well being care prices. When planning your journey, you should definitely test your present medical insurance to search out out if it should cowl you within the U.S.

For a monthlong keep within the U.S., the lowest-priced guests insurance coverage coverage was round $75 (Trawick Worldwide Protected Travels USA Price Saver) and the very best was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, relying on the coverage.

Methods to maximize your rewards

You desire a journey bank card that prioritizes what’s necessary to you. Listed below are our picks for the finest journey bank cards of 2024, together with these finest for: