In the end, the time has lastly come for the Fed to start chopping charges in September. In consequence, actual property buyers will probably profit from a tailwind over the subsequent couple of years, after a tough prior two years.

Mortgage charges peaked in October 2023 however rose once more from December 2023 via April 2024. Now, we are able to assume with higher confidence charges ought to proceed trending decrease because the Fed begins chopping the quick finish of the curve. Because the economic system softens, rates of interest will probably keep muted.

Within the spring of 2024, we noticed some wild bidding wars, however exercise has slowed for 2 foremost causes. First, a big variety of consumers are ready for affirmation of price cuts earlier than getting into the market. Second, with the November 5, 2024, presidential election looming, many consumers are opting to attend and see who takes workplace earlier than making one of many greatest purchases of their lives.

Given the drop in mortgage charges and the present hesitancy amongst consumers—particularly through the historically slower second half of the 12 months—there is a window of alternative to buy residential actual property proper now at higher costs. Fall and Winter are my favourite seasons to purchase on account of much less competitors.

Demand For Actual Property May Surge Larger

In my podcast with Ben Miller, CEO of Fundrise, we focus on how a detrimental actual property unfold is holding again funding committees from approving business actual property offers. A detrimental unfold happens when borrowing prices exceed property yields, which has induced transaction volumes to drop considerably.

Nonetheless, as soon as we see a impartial or optimistic actual property unfold—largely pushed by falling rates of interest—we’ll probably expertise a surge in buy exercise, pushing costs larger.

That stated, the longer term stays unsure. Mortgage charges might stay flat and even rise once more, dampening demand. But when the Fed begins chopping the Fed Funds price whereas longer-term charges rise, we’ll see a steepening yield curve, which is often a bullish sign for the economic system. So long as the Fed continues chopping charges, actual property buyers ought to profit from optimistic momentum.

We’re already seeing actual property ETFs like XLRE and VNQ hit 12-month highs, together with public REITs equivalent to O, SPG, DLR, and PSA. This surge is in anticipation of price cuts and elevated working revenue. In consequence, there could also be an arbitrage alternative to put money into non-public actual property funds that haven’t but revalued their Internet Asset Values (NAVs).

Investing In Actual Property Throughout A Multi-12 months Price Lower Cycle

Click on the play button within the embedded participant to take heed to our dialog, or go to Apple and Spotify on to pay attention.

Listed below are my present notes for my dialog with Ben Miller, CEO of Fundrise about what’s subsequent in actual property.

Major Theme:

Rates of interest are probably the most vital driver of actual property costs, surpassing operational enhancements. Residences are more likely to profit probably the most by the tip of 2025.

Actual Property Market Insights:

Residences: Finest-performing asset class. The much less folks can afford houses, the extra they lease—benefiting condo house owners.

Workplace Sector: Going through everlasting demand decline of 30-50%, compounded by a cyclical downturn. Nonetheless is unwilling to purchase the house.

Industrial Sector: Reasonably pro-cyclical, pushed by financial movement of products. Finest asset class after Residences.

Financial Outlook:

Recession Prediction: A light recession is probably going, which can be unhealthy for shares, however good for residential actual property.

Increase-Bust Cycles: Largely on account of oversupply and undersupply. The trade is digesting overbuilding from 2020-2021, and there’ll probably be an undersupply once more in 2025+ given underbidding from 2022-2024.

Class A properties are yielding 5.5%-6%, which implies the market might “clear in a single day” as soon as borrowing prices decline to those ranges or beneath, sparking a actual property increase.

Funding Insights:

Resolution-Making in Funds: Institutional buyers held again on shopping for business actual property in 2023-2024 on account of detrimental actual property arbitrage (when rates of interest exceed buy worth yields). This prevents offers from passing funding committees. Nonetheless, To outperform, funds should make investments counter to consensus.

Inhabitants Development Is The Largest Driver Of Actual Property Costs: Sturdy progress in Texas, Florida, North Carolina, South Carolina, and Georgia is driving actual property demand. The condo sector could possibly be the largest winner by the second half of 2025 on account of low provide, excessive migration, and decrease rates of interest.

Secular Tendencies & Authorities Insurance policies:

City Decline: Collapse of downtowns on account of declining demand for workplace house. Knock-on impact for presidency income and attracting extra companies. Not bullish on blue cities downtown, nevertheless, understands there are geoarbitrage alternatives inside cities.

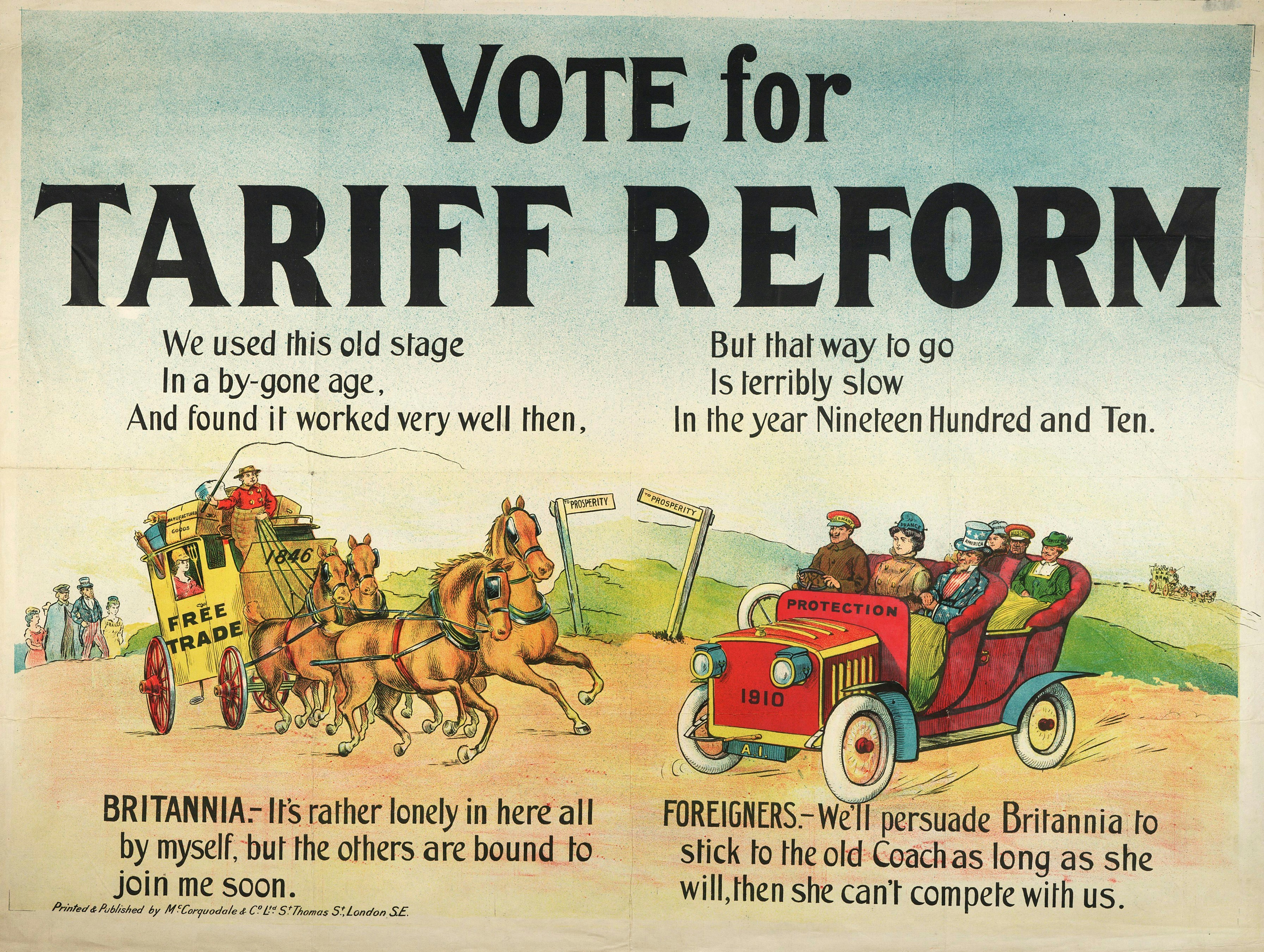

Authorities Coverage: Potential $25,000 credit score for first-time homebuyers and incentives for builders might impression the housing market. So might rising tariffs on imported items which will go in direction of housing subsidies and credit.

Funding Outlook:

Fairness markets aren’t pricing in a recession, however credit score markets are—a greater predictor. Due to this fact, Ben is just not shopping for public equities, and shopping for bonds, actual property, and enterprise capital as an alternative.

Reader Questions

Share your ideas on investing in actual property at the beginning of a multi-year rate of interest minimize cycle. Are you bullish, impartial, or bearish on residential and business actual property, and why? Do you assume provide would possibly outpace demand regardless of the numerous housing scarcity, significantly from 2022-2024 when borrowing charges surged?

If you happen to’re contemplating investing in non-public actual property, check out Fundrise. They handle non-public actual property funds centered on the Sunbelt area, the place valuations are decrease, and yields are larger. Fundrise focuses on residential and industrial actual property, providing buyers diversification and passive revenue potential.

At present, Fundrise manages over $3.5 billion for greater than 500,000 buyers. I’ve personally invested over $270,000 with Fundrise, and so they’ve been a proud sponsor of Monetary Samurai for years.