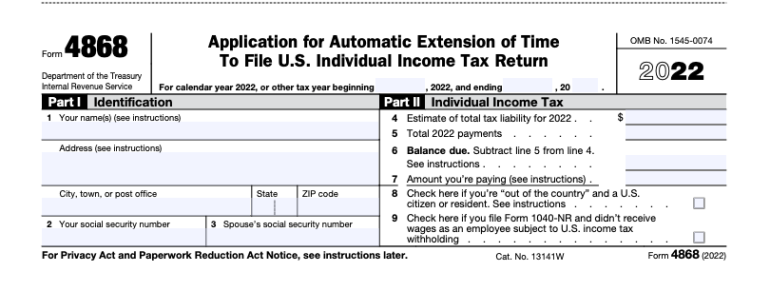

What’s IRS Kind 4868?

Kind 4868, also called an “Software for Automated Extension of Time to File U.S. Particular person Earnings Tax Return,” is a kind that taxpayers can file with the IRS in the event that they want extra time to complete their tax returns.

A profitable software extends the submitting deadline by six months in a typical tax 12 months. It may be filed electronically or by mail.

Needless to say the deadline to submit Kind 4868 is tax day, which is normally in mid-April. If you happen to miss the deadline, your likelihood to ask for an extension expires and the IRS will think about your tax return late.

How does Kind 4868 work?

Opposite to the way it could sound, a tax extension gained’t grant you extra time to pay or cope with your tax invoice. Submitting Kind 4868 merely informs the company that your tax return (usually Kind 1040 and any associated paperwork) will arrive late.

If you’ll owe taxes, you’ll have to estimate your tax invoice and submit an estimated fee by tax day alongside along with your extension request.

Your estimated fee ought to cowl at the very least 90% of what you owe, and the remaining quantity must be paid while you file your return. In case your estimated fee doesn’t cowl at the very least 90% of your legal responsibility, the IRS will cost curiosity and a late-payment penalty on the excellent steadiness as soon as tax day passes

.

How a lot additional time does Kind 4868 provide you with?

Kind 4868 extends your tax-filing deadline by six months, from mid-April to mid-October. The IRS typically doesn’t allow further extensions past the preliminary six months.

Ought to I file Kind 4868?

There are numerous causes to think about submitting Kind 4868. The most typical one is solely needing extra time to gather paperwork. Different causes embrace:

-

You, your CPA or your tax preparer gained’t have the ability to end your tax return by the deadline.

-

You can not file on time due to a big life, medical or journey occasion.

-

You need to keep away from incurring a failure-to-file penalty.

-

You might be self-employed and wish additional time to arrange a SEP plan, which you’ll fund till the tax extension deadline. Solo 401(ks) and SIMPLE plans may also be funded till the extension deadline.

No matter which eventualities apply, together with submitting for an extension, be sure that to nonetheless pay an estimate of your taxes owed.

When to not file Kind 4868

Submitting Kind 4868 would not make sense when you’re pushing aside your return as a result of you’ll be able to’t afford the tax invoice. A tax extension request gained’t provide you with extra time to determine that fee, so the longer you wait to file or pay after tax day passes, the extra curiosity and penalties accumulate.

If you happen to can’t afford a tax invoice, attempt to file on time, pay as a lot as you’ll be able to, and look into the various choices obtainable for fee, together with IRS fee plans.

Who can file Kind 4868?

Most taxpayers can file Kind 4868 to request an computerized six-month tax-filing extension. Per the company, you don’t want to present a purpose for requesting an extension, but when your request is denied, the IRS will contact you to let you recognize why.

Find out how to file Kind 4868

There are a number of methods to submit Kind 4868.

-

By paper: Taxpayers can file Kind 4868 by mail, however keep in mind to get your request within the mail by tax day.

-

Electronically: IRS Free File, IRS Free Fillable Varieties, or tax-prep software program may help you e-file your extension.

-

Once you pay estimated taxes: This third possibility does away with the paperwork. Once you pay your estimated tax invoice utilizing an IRS fee methodology equivalent to Direct Pay, Digital Federal Tax Fee System (EFTPS), or by credit score or debit, you’ll be able to point out that the fee is for an extension

.

What info goes on Kind 4868?

Kind 4868 asks you to provide fundamental info, equivalent to your identify, tackle, Social Safety quantity or particular person taxpayer identification quantity (ITIN). If you happen to owe taxes, you’ll additionally want to incorporate an estimate of that invoice and the quantity of fee you’re making.

You may estimate your taxes by referencing how a lot you owed final 12 months in case your earnings has not modified drastically. It’s also possible to estimate your taxes utilizing a tax calculator or tax-prep software program. Nevertheless, working with a tax professional, or utilizing IRS Kind 1040-ES, could guarantee a more in-depth estimate.

What’s the price of submitting Kind 4868?

You may file Kind 4868 by mailing the paper extension, requiring you to cowl the postage price. It’s also possible to file the shape at no cost utilizing IRS Free Fillable Varieties on-line. A number of IRS Free File suppliers provide taxpayers free digital extension submitting, no matter earnings degree

.

If you happen to’re already dedicated to a specific tax-prep software program, many brand-name suppliers additionally provide free extension submitting, however they might acquire charges for the service the nearer you might be to the tax-filing deadline.

The place to obtain Kind 4868

If you happen to’re utilizing tax software program, most packages will enable you fill out the shape, tally your estimated taxes, and e-file the shape together with fee.

If you happen to’re submitting a paper kind, you’ll be able to obtain and print it straight from the IRS web site.

The place to ship a paper Kind 4868

Submitting a paper extension by mail requires a number of further steps. As soon as your kind is prepared, mail it to your state’s relevant IRS or Treasury Division tackle.

If you happen to’re sending in a fee along with your request extension, the verify or cash order ought to be made out to the “United States Treasury” and you should definitely embrace your Social Safety quantity, cellphone quantity, in addition to a be aware that lists the tax 12 months and what the verify is for (e.g., 2022 Kind 4868).

The IRS would not settle for money funds for paper extensions. For extra info, see the directions to Kind 4868.

The place to mail paper Kind 4868

|

State of residence |

If you happen to’re sending an estimated tax fee along with your Kind 4868: |

If you happen to’re not sending an estimated tax fee along with your Kind 4868: |

|---|---|---|

|

Florida, Louisiana, Mississippi, Texas. |

Inside Income Service |

Division of the Treasury, |

|

Arizona, New Mexico. |

Inside Income Service |

Division of the Treasury, |

|

Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin. |

Inside Income Service |

Division of the Treasury, |

|

Pennsylvania. |

Inside Income Service |

Division of the Treasury, |

|

Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming. |

Inside Income Service |

Division of the Treasury, |

|

Alabama, Georgia, North Carolina, South Carolina, Tennessee. |

Inside Income Service |

Division of the Treasury, |

|

For extra info on the place to ship a paper extension request when you dwell abroad, American Samoa, Puerto Rico, use an APO or FPO tackle, are a dual-status citizen or non-permanent residents of Guam or the U.S. Virgin Islands, see the directions for Kind 4868. |

||

Don’t overlook in regards to the Kind 4868 deadline

Figuring out you’ve purchased your self a number of additional months to file can carry reduction, however don’t overlook to mark your calendar with that new mid-October deadline. If you happen to miss the tax extension deadline, the IRS gained’t provide further choices and people charges and penalties will start to pile up.