401(ok) restrictions

The 401(ok) isn’t tax-free, although. There are just a few restrictions.

- First, the federal government has to get its tax income someday, so that you’ll pay strange revenue tax on the cash you withdraw round retirement age. (Keep in mind, although, that every one that cash has been rising “tax-deferred” for ~30 years.)

- Second, you’re presently (in 2015) restricted to placing $18,000/12 months in your 401(ok).

- Third, and that is essential, you’ll be charged an enormous penalty of 10% when you withdraw your cash earlier than you’re 59.5 years outdated.

That is intentional: This cash is to your retirement, to not exit ingesting on Saturday.

You may name up your HR consultant on Monday and get enrolled in your 401(ok).

Begin an automatic-payment plan so cash is taken straight out of your paycheck.

Mastering your Roth IRA

In order for you actual wealth in your retirement, you completely want a Roth IRA. It’s one other sort of retirement account.

And each individual ought to have a Roth IRA. It’s merely the perfect deal on the market for long-term investing.

Keep in mind how your 401(ok) makes use of pre-tax {dollars} and also you pay revenue tax while you take the cash out at retirement?

Properly, a Roth IRA is totally different than a 401(ok). A Roth makes use of after-tax {dollars} to present you an excellent higher deal.

Right here’s the way it works:

If you earn cash yearly, it’s important to pay taxes on it. With a Roth, you are taking this aftertax cash, make investments it, and pay no taxes while you withdraw it.

If Roth IRAs had been round in 1970 and also you’d invested $10,000 in Southwest Airways, you’d solely have needed to pay taxes on the preliminary $10,000 revenue.

If you withdrew the cash 30 years later, you wouldn’t have needed to pay any taxes on it. Oh, and by the best way, your $10,000 would have became $10 million.

Give it some thought.

You pay taxes on the preliminary quantity, however not the earnings. And over 30 years, that could be a stunningly whole lot.

Roth IRA Restrictions

Once more, you’re anticipated to deal with this as a long-term funding car.

You’re penalized when you withdraw your earnings earlier than you’re 59.5 years outdated. (Exception: You may withdraw your principal, or the quantity you truly invested out of your pocket, at any time, penalty-free. Most individuals don’t know this.)

There are additionally exceptions for down funds on a house, funding schooling for you/companion/ kids/grandchildren, and another emergency causes.

And there’s a most revenue of $181,000 to make full contributions to a Roth. However you may examine these later.

What’s the massive takeaway from all these restrictions and exceptions? I see 2 issues:

First, you may solely get a few of these exceptions in case your Roth IRA has been open for five years. This motive alone is sufficient so that you can open your Roth IRA on Monday.

I need you to analysis it this weekend, and I need your Roth IRA opened by subsequent week.

Second, beginning early is essential. I’m not going to belabor the purpose, however each greenback you make investments now’s value a lot, far more later. Even ready two years can price you tens of 1000’s of {dollars}.

At present, the utmost you’re allowed to spend money on your Roth IRA is $5,500 a 12 months (up to date in 2008). I don’t care the place you get the cash, however get it. Put it in your Roth and max it out this 12 months.

These early years are too essential to be lazy.

Open your Roth IRA

It’s simple. You may undergo your present low cost brokerage, like E*Commerce or Scottrade.

I created a video to assist present you the way to decide on a Roth IRA

Subsequent, name them up, inform them you need to open a Roth IRA, and so they’ll stroll you thru it. Particular observe: These locations have minimal quantities for opening a Roth IRA, normally $3,000. Typically they’ll waive the minimums when you arrange an computerized cost plan depositing, say, $100/month.

Store round although.

As soon as your account is about up, your cash will simply be sitting there. You must do issues then:

First, arrange an computerized cost plan so that you’re robotically depositing cash into your Roth. How a lot? Attempt doing as a lot as you’re comfy with, plus 10%.

Second, resolve the place to take a position your Roth cash. I like to recommend low-cost, diversified index funds as the best choice or goal date funds.

401(ok) or Roth IRA?

The easy reply is each: These accounts, whereas conceptually totally different, work collectively fairly properly.

Right here’s how I give it some thought.

First, I might max out any 401(ok) match that my firm gives. Second, I’d max out the $5,500 for my Roth IRA. Third, I’d max out the remainder of my 401(ok), as much as $15,000. Lastly–in case your employer doesn’t supply a 401(ok), you’re not employed but, otherwise you nonetheless have cash left over–I’d open a daily, taxable funding account and put cash there in shares, index funds, and so forth.

Why max out your Roth IRA earlier than your 401(ok)?

Properly, there’s plenty of dorky debate within the personal-finance world, however the primary causes are taxes and tax coverage: Assuming your profession goes properly, you’ll be in the next tax bracket while you retire, that means that you simply’d should pay extra taxes with a 401(ok). One other frequent motive for the Roth is that tax charges are thought-about more likely to enhance.

Keep in mind: Your 401(ok) cash is taxed on the finish, whereas Roth IRA cash is taxed instantly after which grows tax-free.

What to do at this time

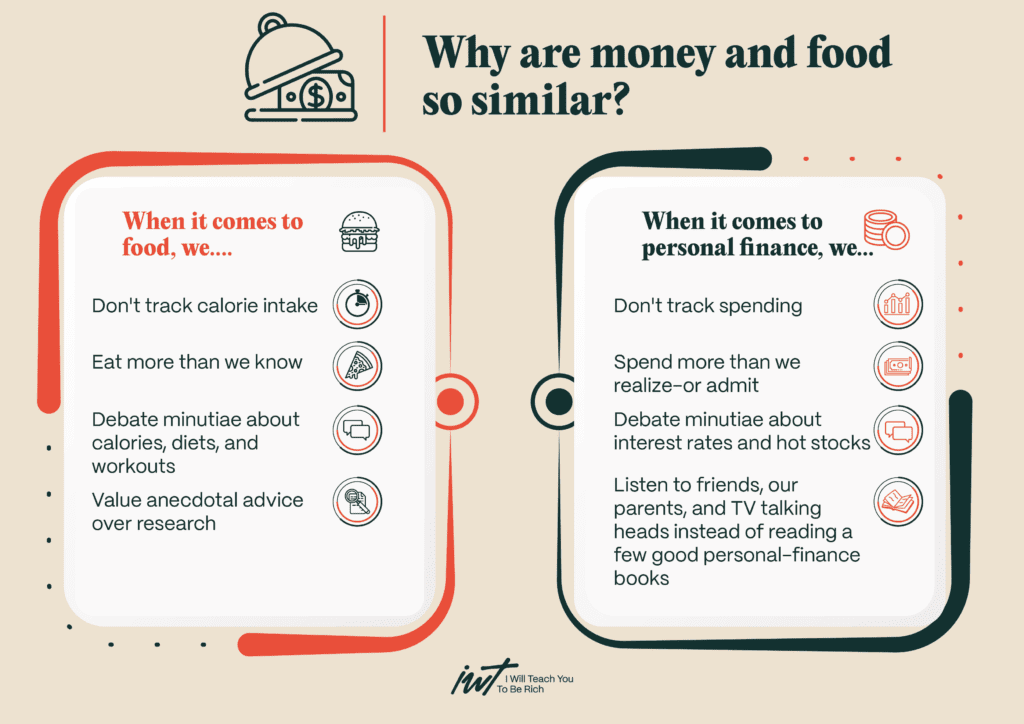

In the case of cash, it’s very simple to finish up like most individuals – simply doing nothing.

So let the fools debate. For you, simply get your accounts open.